New York Gov. Kathy Hochul and state regulators rung in the New Year by celebrating a milestone for their adult-use cannabis market: $1 billion in cumulative sales since Dec. 29, 2022, when the retail market for those 21 and older commenced.

That two-year total includes $150.9 million in adult-use sales in 2023 and an estimated $870 million in adult-use sales for 2024, according to the New York Office of Cannabis Management (OCM). The office hasn’t officially released finalized sales data for December.

The 10-figure milestone came as New York’s adult-use retail footprint grew from roughly 40 dispensaries at the beginning of 2024 to 270 dispensaries open for business by the end of the year, according to the OCM. And that number is increasing weekly: As of Jan. 3, there were 281 adult-use dispensaries open for business.

The milestone also came as state officials conducted some 1,300 enforcement inspections, padlocking 450 unlicensed businesses and seizing 16,900 pounds of unregulated cannabis products worth an estimated $68.5 million, according to the OCM.

RELATED: New York City Ordered to Lift Padlock on Smoke Shop Suspected of Unlicensed Cannabis Sales

“Earlier this year, my administration took critical steps to promote progress and economic opportunity within New York’s budding cannabis industry, including signing new enforcement powers into law that expedited the closure of unlicensed storefronts and, as a result, bolstered our legal market,” Hochul said on Dec. 31. “Today, we recognize the $1 billion milestone as more than just a number—it’s a testament to the hard work of those who helped build the strongest cannabis industry in the nation: one that prioritizes equity, ensures public safety and empowers communities.”

Although $1 billion in adult-use sales during the first two years of a state’s market is nothing to sneeze at, several states have reached that milestone quicker, including Arizona, California, Illinois, Maryland, Massachusetts, Michigan, Missouri, New Jersey and Nevada.

However, New York’s medical cannabis sales figures remained unsung. Once fully tabulated, they could push the state’s overall cannabis market past the $1 billion benchmark in 2024 alone—rather than the governor celebrating it as a two-year milestone.

New York’s 32 medical cannabis dispensaries—including 21 medical-only stores and 11 stores co-located with adult-use operations—averaged more than $10.5 million in medical cannabis sales per month from January through August 2024, according to public records that Cannabis Business Times requested months ago but just recently received.

Michael Waller, deputy counsel with the OCM, informed CBT that the office was still collecting additional sales data for June, July and August when the Freedom of Information Law (FOIL) request was fulfilled on Jan. 3—140 days after CBT requested the medical sales data on Aug. 16.

In mid-November, Waller told CBT that as the office’s need grew within the illicit operator space, it became short-staffed in responding to FOIL requests.

According to New York law, the public’s right to gain access to government records requires agencies to respond to FOIL requests within five business days and to provide an approximate date for when the request will be fulfilled—typically within 20 business days.

With more than 100,000 patients and nearly 8,500 caregivers registered with its medical cannabis program, it’s unusual that New York doesn’t make medical cannabis sales data readily available to the public each month. Along with Alaska and Vermont, it is one of three adult-use states nationwide that neglects to do so.

However, more than two years into adult-use sales, New York cannabis regulators still haven’t fully implemented a universal seed-to-sale tracking system, making it difficult for the OCM to know precisely what products are being sold in the dispensaries operating under its authority, as one Cannabis Control Board member indicated last month.

RELATED: Product Inversion is New York Cannabis Market’s ‘Dirty Little Secret’

Based on monthly figures through August that CBT received via the FOIL request, New York’s medical cannabis market was on pace to conservatively record $126.4 million in sales in 2024, a 19% decrease from the $155.7 million in medical cannabis sales from 2023.

That $126.4 million in medical sales combined with the estimated $870 million in adult-use sales puts New York’s overall licensed cannabis market on the cusp of eclipsing $1 billion for the year in 2024.

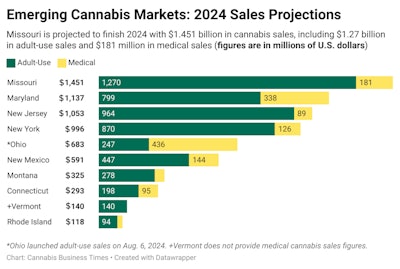

Twelve other states, including two medical-only markets, eclipsed the billion-dollar marks this past year: California ($4.7 billion), Michigan ($3.3 billion), Florida ($2.1 billion), Illinois ($2 billion), Massachusetts ($1.8 billion), Pennsylvania ($1.7 billion), Missouri ($1.45 billion), Colorado ($1.4 billion), Arizona ($1.3 billion), Washington ($1.2 billion), Maryland ($1.1 billion) and New Jersey ($1 billion).

Despite having smaller populations, Missouri, Maryland and New Jersey’s cannabis markets are outperforming New York’s market. All four states launched adult-use sales within 14 months of one another.

Here’s a look at how New York compares to other emerging state markets that have launched adult-use sales since the beginning of 2022:

Various state agencies

Various state agencies

While Hochul and New York’s cannabis regulators celebrated the two-year milestone of $1 billion in adult-use cannabis sales, they overlooked the state’s medical cannabis sales figures.

However, they did not overlook their commitment to creating an industry that prioritizes opportunities for those who were unjustly impacted by prohibition policies during the drug war. More than half of all adult-use licenses in New York have been awarded to social and economic equity applicants, with significant representation from minority- and women-owned businesses, according to the OCM.

“This milestone is a testament to the resilience, hard work and innovation of cannabis entrepreneurs across New York. As $1 billion is an incredible number,” OCM Acting Executive Director Felicia A.B. Reid said. “Let us celebrate the individuals, businesses and communities in cannabis who drive our state’s economic engine. Certainly, this moment underscores the strength of consumer demand for regulated cannabis. More importantly, it firmly demonstrates that a social and economic equity approach to industry is not antithetical to strong economic growth. New Yorkers have placed their trust in a market that prioritizes equity—and OCM remains committed to supporting that mission.”

Source link

#Yorks #Medical #Cannabis #Sales #Figures #Unsung